What is a mortgage amortization schedule and how does it work?

Let’s say you want to buy a home. Few people have enough cash to purchase the house outright, don’t have a wealthy aunt, grandparent or parent and don’t want to wait until they’re 100 years old to purchase a home. Assuming you’re about as responsible with money and work as the next guy, one solution is to use a loan from a mortgage bank (like Loanatik) and borrow the money you need to buy the house. When the money you borrow is secured by real estate it’s called a mortgage. By taking money from the bank they essentially become your business partner until the money you borrowed, plus interest, has been paid back.

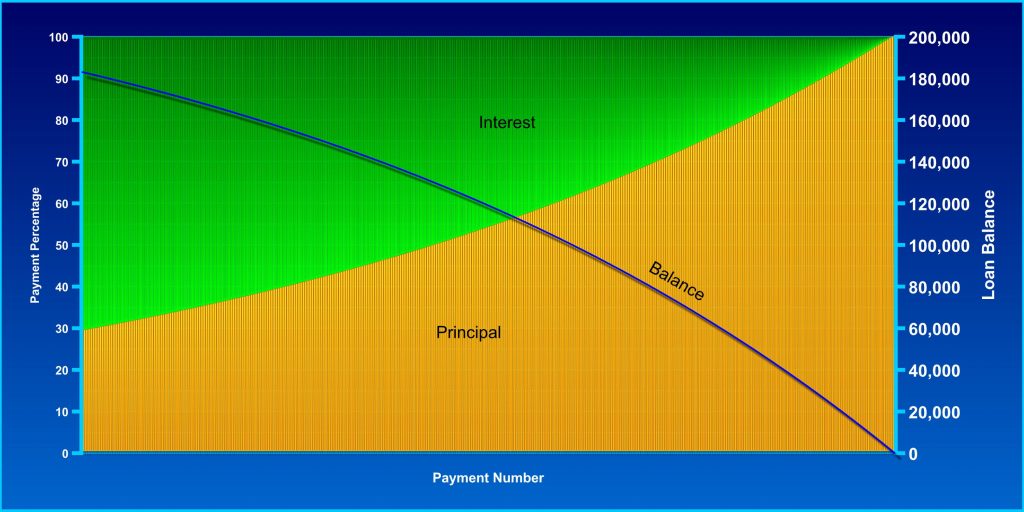

While partners are great, they also make life more complex: they have rules and regulations and always want their payments on time. You’d rather own your house outright. So, each month, in addition to the interest due on the money you borrowed, you also pay a little bit of the principal. The next month, because you’ve reduced the principal, the interest payment is a little lower. You can now add the money you would have spent on interest to your principal payment, reducing the principal even more. This process of paying down the mortgage, a little bit at a time, is called amortization. It may be easiest to illustrate this concept with an example:

Let’s assume that you borrow $1,000 at 10% interest and your monthly payment is $88. Each month the $88 will be split between interest and principal according to this table:

| Date | Payment | Interest | Principal | Balance |

|---|---|---|---|---|

| Apr | $88 | $8 | $80 | $920 |

| May | $88 | $8 | $80 | $840 |

| Jun | $88 | $7 | $81 | $759 |

| Jul | $88 | $6 | $82 | $678 |

| Aug | $88 | $6 | $82 | $595 |

| Sep | $88 | $5 | $83 | $512 |

| Oct | $88 | $4 | $84 | $429 |

| Nov | $88 | $4 | $84 | $344 |

| Dec | $88 | $3 | $85 | $259 |

| Jan | $88 | $2 | $86 | $174 |

| Feb | $88 | $1 | $86 | $87 |

| Mar | $88 | $1 | $87 | $0 |

At the end of one year, you will have paid $55 in total and paid off the entire loan.

COMMENTS